Captive Insurance for Prefab Housing Installation

A data-driven insurance model serving 12 General Contractors across three distinct market segments: Student Housing, Multi-Generational Living, and Rural Development.

The Business Model

12 Risk Units

Independent General Contractors installing prefab housing units across Arizona, providing true risk distribution.

3 Market Segments

Student housing, multi-generational equity instruments, and rural development—uncorrelated risk profiles.

Monte Carlo Validated

10,000+ simulations demonstrate <1% probability of ruin over 10 years.

Key Performance Indicators

Risk Coverage

The captive provides comprehensive coverage for three primary risk categories:

Construction Defects

- Structural integrity issues

- Material defects

- Installation errors

- Code compliance failures

Utility Integration

- Water connection failures

- Electrical system issues

- Gas line problems

- Septic system failures

Schedule Delays

- GC availability constraints

- Supply chain disruptions

- Weather delays

- Permit processing

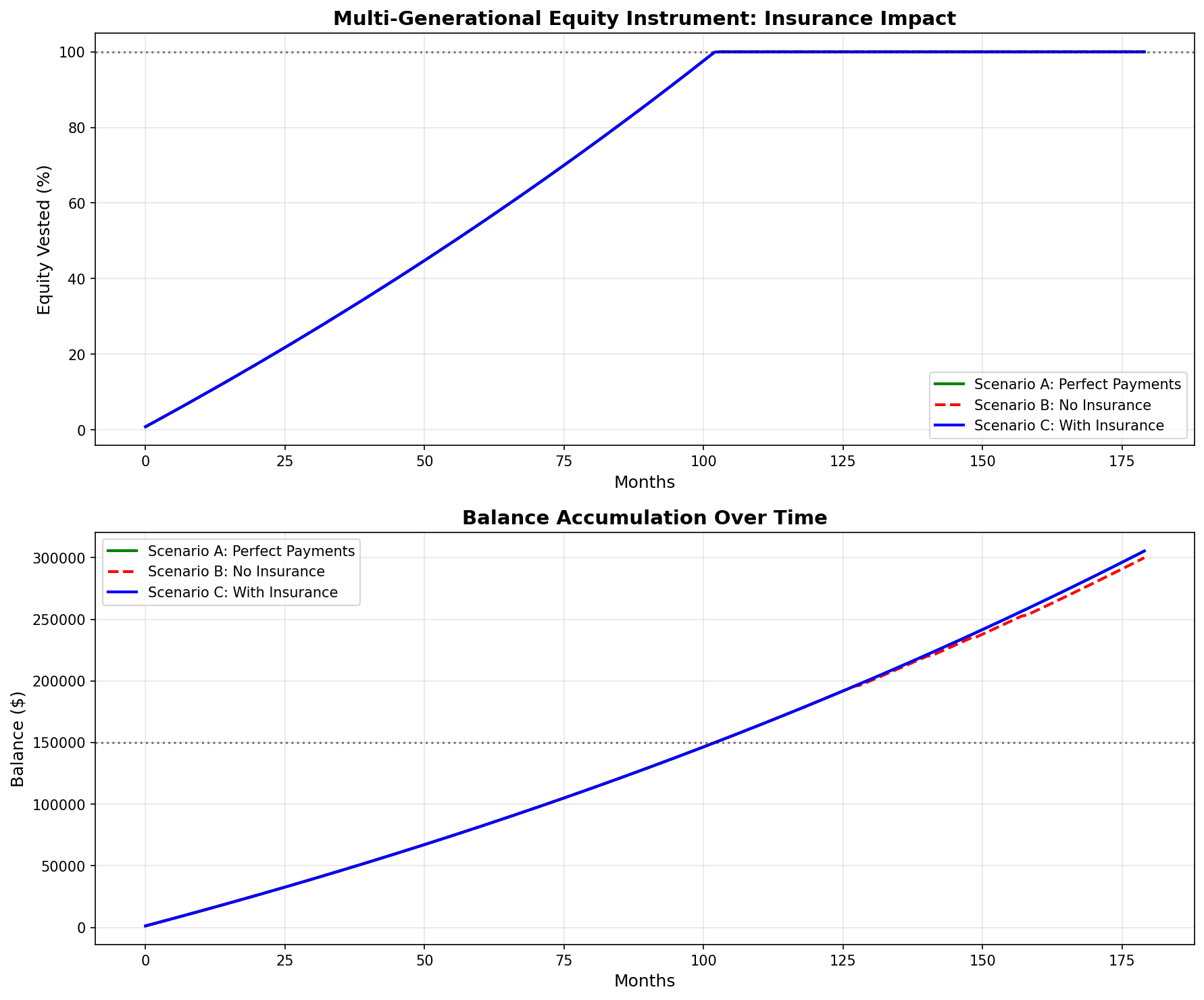

The Multi-Generational Innovation

Rent-to-Equity Financial Instrument

Our unique multi-generational housing model creates a financial instrument where:

- Parents invest in an accessible ADU (Accessory Dwelling Unit)

- Children pay rent that accumulates with interest

- Equity transfers to the child over time

- Residence swap occurs when parents need accessibility features

This structure mitigates vacancy risk and default risk, reducing long-term claim probability for the captive.

Ready to Review the Data?

Explore our comprehensive simulation results and regulatory compliance documentation.